Corporate

Governance

Structure and practices

GRI 2-9, 2-11, 2-14, 2-17

In a transformative year for Natura &Co, our corporate governance played a decisive role in making strategic and necessary decisions that bolstered the foundation for our future growth.

Timely and accurate decision-making

At the 2023 Annual General Meeting, shareholders approved significant structural changes proposed by the Company’s management culminating, among others, in the reduction of the Board of Directors, the disappearance of the positions of Executive Chairman of the Board of Directors and Group CEO and the creation of the position of Chief Executive Officer. These necessary adjustments were part of the corporate governance restructuring process focused on the shareholders’ expectations of a leaner structure. Then Directors Ian Martin Bickley, Jessica DiLullo Herrin, Wyllie Don Cornwell, Nancy Killefer, and Fábio Colletti Barbosa resigned, and Bruno de Araújo Lima Rocha and Maria Eduarda Mascarenhas Kertész were elected at the General Shareholders’ Meeting. For more details on the Board of Directors composition, please refer to our Investor Relations website.

The Board also has one-third of women in its composition, and two foreign members.

The current composition of the Board of Directors continues to comprise three Co-Chairmen of the Board, who are also Co-Founders of Natura Cosméticos and part of the controlling group, and signatories of the shareholder's agreement. Pursuant to the Company’s bylaws, one of the Co-Chairmen presides over the Board meetings. Currently, Guilherme Pereira Leal plays this role. The remaining six Board members are independent, far exceeding the independence percentage established by Brazilian CVM and B3’s Novo Mercado rules that the Company must follow. The Board also has one-third of women in its composition, and two foreign members. We follow the recommendations of the Brazilian Code of Corporate Governance, of the Brazilian Institute of Corporate Governance (IBGC). Furthermore, we operate in line with the requirements of the New York Stock Exchange (NYSE), in which, until February 2024, our American Depositary Receipts (ADRs) were listed.

The Board of Directors dedicated a significant amount of time discussing the sale of Aesop and The Body Shop, necessitating some extraordinary meetings. Additionally, in 2023, the Board addressed various other crucial topics such as succession planning, talent acquisition and retention, diversity and inclusion initiatives, cash flow and margin management, group strategy, risk assessment, and sustainability efforts. To further bolster our already far-reaching and bold sustainability goals, such as those set in our Commitment to Life, the Board established the Sustainability Committee as the fifth supported committee, holding quarterly meetings.

| Skills | BR | BR | BR | BR | BR | BR | US | GR | BR | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Luiz Seabra |

Pedro Passos |

Guilherme Leal |

Bruno Rocha |

Carla Schmitzberger |

Gilberto Mifano |

Andrew McMaster Jr. |

Georgia Melenikiotou |

Duda Kertész |

|||

| Business |

Finance or Accounting |

Expertise in accounting, auditing, or related financial areas. |

x |

x |

x |

x |

x |

x |

|||

|

Sales, Marketing & Branding |

Experience in marketing, sales management and in building or development of brands. |

x |

x |

x |

x |

x |

x |

x |

x |

||

|

Strategy |

Experience in defining objectives and strategic plans and monitoring their execution. |

x |

x |

x |

x |

x |

x |

x |

x |

x |

|

|

Innovation |

Awareness in innovations with the potential to influence the business. |

x |

x |

x |

x |

x |

x |

||||

|

Digital |

Digitally savvy and able to contribute to the company's digital initiatives and strategies. |

x |

x |

x |

|||||||

|

International Experience |

Experience or a deep understanding of global markets, particularly Latin America, and exposure to diverse political, cultural and business frameworks. |

x |

x |

x |

x |

x |

x |

x |

x |

x |

|

|

Leadership |

Experience in senior leadership positions in large and/or companies relevant in their industry. |

x |

x |

x |

x |

x |

x |

x |

x |

||

|

Legal and Regulatory |

Experience in legal and regulatory frameworks. |

x |

x |

x |

x |

x |

|||||

|

ESG |

Experience in matters related to environment, social and/or governance. |

x |

x |

x |

x |

x |

x |

||||

|

Risk and Compliance |

Experience in risk management and prevention frameworks and/or Compliance. |

x |

x |

x |

x |

x |

x |

x |

|||

|

Operations |

Experience managing/supervising complex supply chains. |

x |

x |

x |

x |

x |

x |

||||

|

People Management and Organizational Design |

Experience in talent development and organizational structures. |

x |

x |

x |

x |

x |

x |

x |

x |

x |

|

| Industry-specific |

Direct Selling |

Experience or deep knowledge of the direct selling model. |

x |

x |

x |

||||||

|

Consumer goods industry - Beauty and health |

Experience or deep knowledge of the beauty and health segment of the consumer goods industry. |

x |

x |

x |

x |

x |

x |

x |

|||

| Soft Skills* |

Emotional Maturity |

Self-awareness of your emotions and empathy towards the emotions of the other; ability to maintain emotional balance and prioritise thoughtful solutions in adverse situations. |

|||||||||

|

Communication |

Ability to establish and encourage efficient, transparent and objective communication between team members and management. |

||||||||||

|

Identification with the Company's values |

Familiarity and identification with the Company’s view of the world and values, including ethics, objectives and its Reason for Being. |

||||||||||

*Skills considered in the directors' recruitment process - subjective assessment of the Company.

Please refer to our Investor Relations website for more details on the Board of Directors' composition, professional biographies, competencies, and demographic details.

Board composition

In 2023, the average tenure for all Board members stood at 2.5 years, accounting for the duration of their service within the Natura &Co Holding since its inception in 2019. For details regarding the complete Board composition, consult the minutes from the Annual General Meeting (AGM) of 2022 and 2023.

The primary role of the Board of Directors is multifaceted. It involves analyzing the effectiveness of the organization’s processes concerning economic, social, and environmental impacts, overseeing the implementation of processes, assessing the results, identifying any gaps or opportunities for improvement, and making strategic decisions. Ultimately, the Board bears the responsibility for ensuring the organization operates ethically, responsibly, and in alignment with its goals and values. This analysis is conducted during strategic planning cycles and at specific events.

Ultimately, the Board bears the responsibility for ensuring the organization operates ethically, responsibly, and in alignment with its goals and values.

The Board of Directors establishes the Company's values, mission, and culture, guidelines related to sustainable development and communicates them through policies and corporate documents. The Board ensures alignment with the approved strategy, considering the interests and purpose of the company, shareholders, and stakeholders. For this, the Board of Directors considers, among others, the short and long-term interests of the company and its shareholders, as well as the economic, social, environmental, and legal effects on employees, suppliers, partners, customers, other creditors, as well as the communities in which the Company operates locally and globally.

In developing and updating guidelines related to sustainable development the Board of Directors is responsible for establishing guidelines, providing strategic supervision, and approving policies and objectives. The senior executives have responsibilities that include strategic leadership, strategy development, implementation and supervision, and external communication

The Board of Directors reviews and approves the information reported in the organization's reports. Additionally, they analyze and approve the organization's material issues. The preparation of the Annual Report is monitored by the Board's Co-Chairs, who ensure that the document adequately reflects the Company's purpose, culture, and other contents. Whilst this role is not mandated by our bylaws, it is considered relevant by both the Co-Chairs and the Board of Directors. The analysis focuses on the messages of the CEO and the Founders, while the executive teams are responsible for preparing the technical topics and ensuring the quality of the information disclosed to the market.

To further expand the theme of sustainable development within the Board of Directors, some measures have been adopted, including the establishment of the Sustainability Committee, which was created to serve as an additional tool to better address Environmental, Social, and Governance (ESG) issues, supporting the Board in these subjects and providing it with periodic reports.

For more information on the qualifications and responsibilities of our governance bodies please click here.

For detailed information regarding the selection, compensation, and duties of Board members and executives within the Holding, please refer to the Corporate Governance Report (click here).

2023 in review

In 2023, the Board of Directors held six regular and four extraordinary meetings with 100% attendance of their members and other invited executives of the Company. During these meetings, the Board reviewed matters within its purview as mandated by law or outlined in our bylaws. This encompassed a wide array of topics including quarterly performance results, the formulation of management compensation packages, annual assessments, risk matrix evaluations, strategic planning discussions, and budget deliberations. As a standard practice, the Board of Directors conducted executive sessions exclusively for its members during each meeting, ensuring candid and focused dialogue on pertinent issues.

Furthermore, the Board of Directors undertook a comprehensive evaluation of the challenging external landscape, considering our financial position and our capacity for business expansion. This analysis ultimately led to the strategic decision to divest two of our four operations, namely Aesop and The Body Shop. The process of arriving at these decisions involved extensive analysis by the executive teams and rigorous and timely deliberations by the Board of Directors, as disclosed to the market. Discussions regarding both projects were a recurring agenda item in most meetings, with particular emphasis during extraordinary sessions.

The Board of Directors also counts on the critical support of five advisory committees, as described below. The annual self-assessment of the Board of Directors and committees results in continuous improvement efforts, with its findings to be addressed in 2024.

Fiscal Council

In addition, for the second year in a row, the Fiscal Council was established during the Annual Shareholders Meeting held on 26 April 2023. The one-year mandate of the three Council members was renewed, with two members appointed by a majority of the shareholders, and the third member by minority shareholders.

The Fiscal Council convened eight times during the 2023 mandate, contemplating four regular and four extraordinary meetings.

Under Brazilian legislation, shareholders representing more than 2% of the company’s capital have the prerogative of requesting the installation of a Fiscal Council, an optional entity distinct and independent from both the Board of Directors and the Company’s executive management. The Fiscal Council represents shareholders' interests within the Company, tasked with overseeing management actions and ensuring compliance with their legal and statutory obligations, especially the quarterly financial statements. One of its primary focuses is to guarantee the quality of the company’s quarterly and annual financial reports.

For further insights into our Corporate Governance framework and committee composition, please refer to www.ri.naturaeco.com.

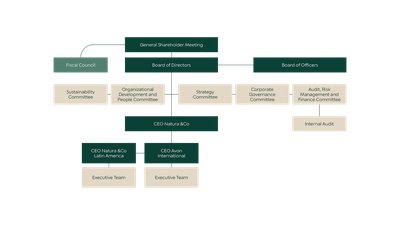

Natura &Co governance structure

| Committee | Meetings | Attendance | Topics Discussed |

|---|---|---|---|

| Audit, Risk Management and Finance Committee |

8 ordinary 4 extraordinary When considering the thematic subcommittees, all linked to the Audit Committee, the number of meetings in 2023 totaled 17 additional meetings |

100% |

In addition to the topics commonly covered through the subcommittees (Finance, Tax and Legal, Internal Audit, and Information Security), it also participated in the sale process of Aesop and The Body Shop. |

| Organization and People Committee* |

5 ordinary 1 extraordinary |

100% |

Short and long-term incentive plans Succession plans Talent development Reward strategy ADR delisting from NYSE |

| Strategy Committee* |

1 ordinary 3 extraordinary |

100% |

Portfolio Business strategy review Organization transition Budget |

| Corporate Governance Committee |

5 ordinary |

100% |

Corporate governance structure Management proposal for the Annual Shareholders Meeting Committees’ composition Board compensation Corporate Governance Report review Board and Governance annual assessment |

| Sustainability Committee |

4 ordinary |

100% |

Preparation of the committee rules and dynamics Support for the reorganization of the Sustainability area Commitment to Life target review |

*The composition of these committees changed in May 2023 following the resignation and appointment of members of the Board of Directors

Commitment to Best Practices

The Company has undergone a substantial evolution in its corporate governance system over the years, demonstrating its steadfast commitment to implementing best practices in corporate governance.

Presently, it adheres to 94% of the recommended practices outlined in the Brazilian Code of Corporate Governance. In 2023, the Company dedicated significant efforts to embrace the new corporate framework and ensure alignment with all code principles previously adhered to. The complete Corporate Governance Report is available here.

Capital markets and shareholders

Natura &Co Holding operates as a stock corporation under the Brazilian Corporation Law. Our shares are publicly traded on the “Novo Mercado” listing segment of the B3 exchange, identified by the ticker symbol “NTCO3”. As of December 31st, 2023, the company's market capitalization stood at BRL 23.4 billion, with 1,386,848,066 common shares outstanding. The free float accounted for 61,02% of the total shares, while the remaining 38.45% were held by controlling shareholders, 0.09% by the Board of Directors and statutory Directors, and 0.45% by our treasury.

In addition to our listing on the B3, we traded American Depositary Shares (ADSs) on the New York Stock Exchange, represented by the ticker symbol “NTCO”. On January 18th, 2024, we announced to our shareholders and the market our Board of Directors' decision to voluntarily delist our ASDs from the NYSE. The delisting occurred on February 9, 2024. This strategic move aligns with our long-term operational simplification objectives. We will maintain our registration under the U.S. Securities Exchange Act of 1934 and uphold our reporting obligations following the delisting of our ASDs at the NYSE.